Long-term care—group settings

While “aging in place” has its benefits, it is expensive to get such individualized care. Plus, it’s rather isolating. Group options require a move, but are more social and cost effective.

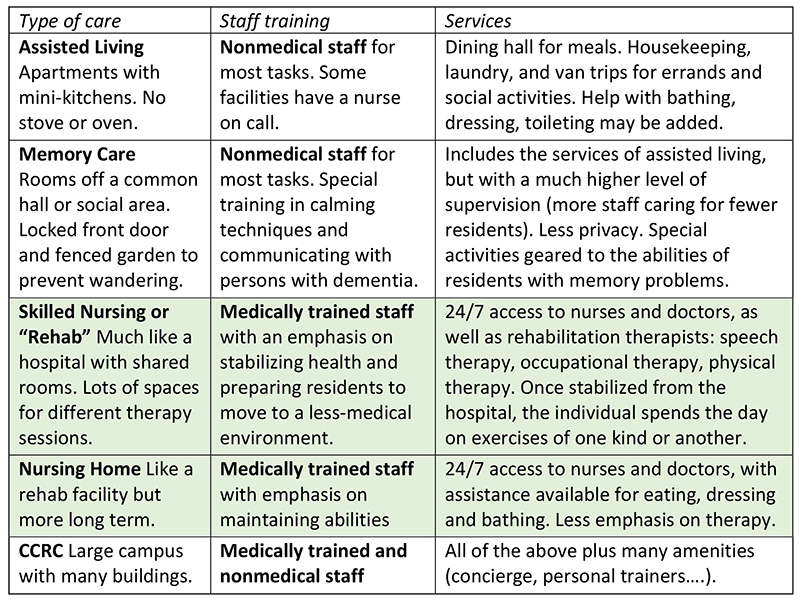

Assisted living. People move to assisted living when they are ready to stop cooking, cleaning, and maybe even driving. They enjoy social activities but need more help than an independent retirement community might offer. Though not a setting for people with advanced dementia, a portion of assisted living residents may have memory problems.

Memory care. With activities specifically for people with significant dementia, memory care may be housed in a wing of assisted living or operate as an independent facility.

Skilled nursing or “rehab.” Geared for short stays—several days to several weeks—a skilled nursing facility can be thought of as a place to get stronger or learn to do things in new ways after a setback. Then you move to a more homelike environment.

Nursing home. This setting is a long-term version of rehab but for those with complex conditions who don’t need a hospital, yet aren’t independent enough for assisted living.

Continuing care retirement community (CCRC). This large “campus” offers all of the above and more. Move in while fully independent and able to enjoy the pool, golf course, etc. As care needs change, residents move to the different care buildings yet stay on the same property. Ideal for a couple when one needs more support than the other.

How to pay for care

Most people are surprised to learn that Medicare pays for only a limited amount of the daily care you are likely to need (about 14%). It only covers services delivered by medically trained professionals (those in green in our chart). That means you need to have savings or insurance and rely on a collection of local programs. Or family and friends who may be able to pitch in with labor or funds.

Most people are surprised to learn that Medicare pays for only a limited amount of the daily care you are likely to need (about 14%). It only covers services delivered by medically trained professionals (those in green in our chart). That means you need to have savings or insurance and rely on a collection of local programs. Or family and friends who may be able to pitch in with labor or funds.

Assisted living and memory care $$$–$$$$

As nonmedical services, these settings are usually paid for out of your own savings. If you are a qualifying veteran or you have long-term care (LTC) insurance, your costs may be covered. Contact the VA or state Veterans Council. Check your LTC policy for eligibility requirements, waiting periods, and any lifetime cap.

Skilled nursing/rehab or nursing home $–$$$$$

Provided your stay follows a qualifying hospitalization, Medicare—the government’s health insurance for seniors—will typically cover 80% of the first 100 days. You use your supplemental insurance for the 20% balance, and then pay 100% for any care beyond day 100. Check your LTC policy for coverage options. The VA offers special facilities for qualifying vets. The very poor may qualify for Medicaid, which will pay 100% of costs. However, there are only a limited number of Medicaid openings available in any given facility. Those living long-term in a nursing home usually exhaust all personal savings and assets, then switch to Medicaid. If you think you may need Medicaid, consult an elder law attorney early, and your financial planner, for advice about liquidating your assets.

Continuing care retirement communities $$$$$

This is a very different model of care that merges housing and insurance. With a CCRC—also known as a Life Plan Community—you invest a substantial sum up front (often in the six figures) and pay a monthly service fee. You start while healthy and live on the campus, moving to the most appropriate building as your care needs change. This is paid for almost entirely out of your own savings. Check your LTC policy to see if it covers CCRC care.

Choosing a facility

Judy had an emergency hip replacement after a fall. She needs to be discharged tomorrow to a skilled nursing facility for several weeks of intensive physical therapy so she can walk again. The discharge planner has a list of options. But Judy and her daughter, who lives an hour away, have no idea which one to choose.

For short-term, urgent needs, you may be at the mercy of which facility has an opening at the time. It pays to consult an eldercare consultant who knows the reputation and personality of the local institutions. When you combine that with a thorough understanding of your medical history, your insurance and financial resources, your personality and preferences, and your social support system, you are more likely to get a match that will help you maintain good spirits and enjoy a speedy recovery.

Such insights and independence are even more important for long-term living situations. Choosing an assisted living community, a CCRC, or a memory care facility is a big decision. You want to get a good match from the start.

Touring these communities can be daunting. They all put their best foot forward. But architectural features and social amenities are only superficial measures of quality. An eldercare consultant has had other clients live in these facilities. He or she has a firm grasp on deeper metrics of quality, such as the tone of the administrative leadership, the training and stability of the staff, and the solvency of the company.

An eldercare consultant also knows current conditions in the market that can save you money. For instance, if a community happens to have a lot of openings, a lower monthly rate or entry fee could be negotiated. Unlike “free” referral agents, you will be presented with all of the choices that make the most sense for your needs and personality, not just the communities that are willing to pay a kickback referral fee.

To learn more, call us at 703-677-8319